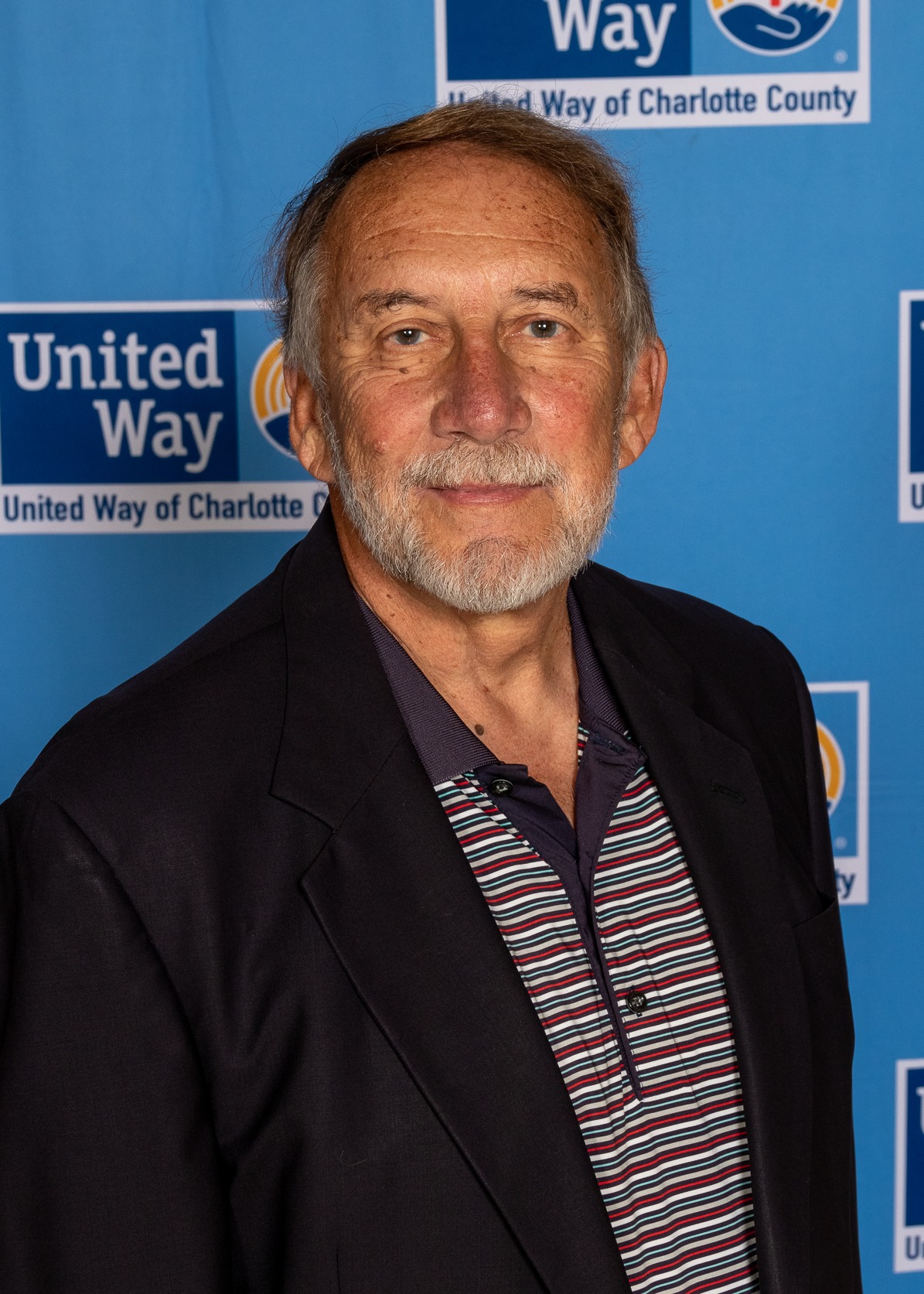

Fred Cort and the Power of Legacy Giving

By Angie Matthiessen, Executive Director - United Way Charlotte County

Some people leave a ripple effect far beyond the years they’re given, and Fred Cort was one of those rare people. Over recent years, Fred helped guide us through difficult transitions with calm strength, steady wisdom, and an unwavering belief in what we could accomplish together.

He often reminded me how much he cared about the well-being of the United Way Charlotte County (UWCC) staff—always taking time to check in, offer encouragement, and share a kind word. During some of my own most challenging times, his quiet support meant more than he probably realized. Fred believed deeply in our mission—but even more so in the people behind it. That’s the kind of legacy that endures.

Fred passed away recently, and while we deeply feel his absence, we continue to be inspired by the legacy he leaves behind.

Fred passed away recently, and while we deeply feel his absence, we continue to be inspired by the legacy he leaves behind.

His journey with United Way began up north, with what he once called “an offer I could not refuse”—chairing a division of an annual campaign. What started as fundraising quickly became something more. To Fred, it was never just about dollars—it was about friend raising. After moving to this community, he became a donor, then a volunteer, and eventually served as our UWCC Board President.

In Fred’s own words, United Way "has always been in the role of helping the community help itself." He believed that giving—whether time, talent, or resources—was not just charity, but an investment in the future. That’s the spirit of legacy giving, and Fred was passionate about it.

Legacy giving is about making a lasting impact by including a charitable organization in your estate plans. Whether through a bequest, life insurance, or other planned gifts, it’s a way to ensure that the causes you care about continue to thrive beyond your lifetime.

Fred understood that while today’s gifts meet today’s needs, legacy gifts help prepare us for tomorrow’s challenges.

He lived this philosophy. Over the years, he took on many board roles, supported staff and volunteers, and focused on building long-term capacity for our community to meet its most pressing needs. His leadership helped shape not just our organization, but the direction of local philanthropy.

Beyond his service, Fred led a life full of meaning. He was a devoted husband to Carol, proud father and grandfather, and a lifelong learner. He found joy in the simple things—rescuing animals, encouraging others with his quiet wisdom, and celebrating the successes of those around him. That same spirit of care and encouragement is what he brought to UWCC, and it’s why his legacy continues to inspire us today.

At UWCC, we will continue to honor Fred’s legacy—not just in words, but in action. Fred showed us how one person’s commitment can ripple through generations. Your own legacy has the power to do the same for Charlotte County.

The future of our community is built today. By choosing to leave a legacy, you can ensure your impact continues for generations to come. Legacy giving doesn’t require great wealth—it simply requires great intention. To learn more about how you can leave a legacy through UWCC, visit unitedwayccfl.org/Legacy

For more information about United Way Charlotte County’s mission: Mobilizing the power of our community so all can thrive, please contact Angie Matthiessen, Executive Director. She can be reached at director@unitedwayccfl.org.

How to Include United Way Charlotte County in Your Will or Estate Plan

It is easy to include United Way Charlotte County in your will or estate plans. Planned gifts can be outright contributions of stock, real estate, or even large sums of cash. On the other hand, the most common form of a deferred planned gift is a charitable bequest, a gift that can be established fairly simply. Planned gifts may support any aspect of United Way, including the annual campaign or investment in the United Way's endowment fund. Here are some of the most popular ways to do this. We would welcome the opportunity to send you additional information or meet with you to take the next steps.

For more information talk to your accountant or financial advisor. Or contact Kristen Szych, Development Director at (941) 627-3539 or rd@unitedwayccfl.org.

A bequest provision can be included in your will when you are creating it, or you can amend your existing will through the use of a codicil. This arrangement provides you with flexibility and control should your circumstances change. You can designate an exact amount or asset or a percentage of the assets in your will.

- You can use FreeWill.com to create a legal will for free in about 20 minutes.

This is an excellent technique for individuals in the highest tax bracket…or those who have sold a business or received a significant bonus and could benefit from an immediate tax deduction.

Perpetuating your gift through a retirement plan is simple, flexible and tax wise. Contact the administrator of your retirement plan to designate United Way as the beneficiary of your retirement plan. They can also let you know what restrictions might apply.

The benefits of naming United Way as the beneficiary of a retirement account include:

- Avoiding potential double taxation on retirement funds gift to heirs (estate tax and income tax).

- Allowing you to continue to draw money out of your retirement account while you are living.

- Providing you with the freedom to change your mind if your situation changes.

- Giving you the satisfaction of knowing that your hard-earned retirement funds will continue to impact people’s lives in our community.

Many contributors are attracted to life insurance because it enables them to make a larger gift than they would otherwise have been able to make. Here’s how it works: you pay the premiums on a life insurance policy that will ultimately produce a sizable gift to United Way. If United Way is named as the owner and beneficiary, you will also receive a tax deduction for the annual premiums.